What is a structured settlement broker? A structured settlement broker is a person with required credentials who represents a party in a lawsuit in proposing, planning, or obtaining structured settlement payments to satisfy a judgment or settlement agreement.

Differences Between Structured Settlement Brokers, Consultants, and Planners

Winning a lawsuit is often the first step in the process of compensation involving the two parties – plaintiff and defendants – and their respective attorneys. Structured settlements – an arrangement that provides the plaintiff with periodic payments over the years or for the rest of the plaintiff’s life[i] – are increasingly used to settle disagreements, secure long-term financial security, and minimize income taxes. An estimated $10 billion of structured settlements are in place today, a total that grows each year.[ii].

Despite their increasing use, potential beneficiaries and their attorneys often do not understand the roles and responsibilities of the different parties that might participate in a structured settlement agreement. One of America’s foremost plaintiff attorneys, Joe Jamail, aggressively uses structured settlements to benefit his clients.

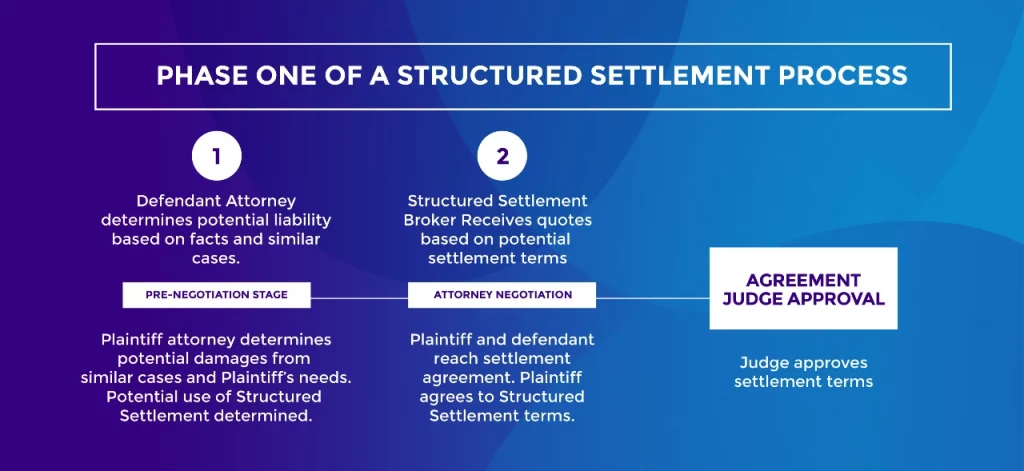

The Structured Settlement Process

Before settlement, the plaintiff and their attorneys consider the plaintiff’s short-term and ongoing needs to develop an equitable damage payment. Determining whether a structured settlement is applicable and if the elements of the settlement are justified requires expert knowledge. The plaintiff’s needs may be immediate (medical expenses, rehabilitation and retraining costs, restoration of lost or damaged assets) and future (long-term care, future education, replacement of lost income and opportunities).

This first phase typically requires actuarial, financial, and investment expertise beyond the experience of most trial lawyers. It typically requires the aid of a qualified structured settlement specialist working with the plaintiff and their family to determine the optimum settlement figure and payment scheme. Attorneys on both sides will research previous awards and settlements to understand the range of a final agreement. Subsequent negotiation by the plaintiff’s and defendant’s attorneys is necessary to reach a final settlement.

Following an agreement for the final settlement with the subsequent approval of the presiding judge, the second phase of the process begins – securing payment of the settlement amount.

Few plaintiffs willingly accept the guarantee of a defendant that payments will be as ordered by the court. An array of known and unknown risks can impinge a defendant’s ability to pay future obligations. Consequently, plaintiffs seek third-party guarantees for payments. On the other hand, defendants typically desire to end a continuing long-term commitment. The solution for both is using an independent intermediary (a qualified assignee) to assume the defendant’s liability in return for an upfront payment sufficient to provide the plaintiff’s future payments.

The qualified assignee then purchases an insurance contract (an annuity) conforming with the settlement terms. While many structured settlements are annuities, most annuities are not structured settlements. The terms of the annuity – the foundation of a structured settlement – necessarily reflect the settlement agreement and may include a cash payment to the plaintiff for attorneys’ fees and court costs in addition to the cost of the annuity.

Since an annuity delivers a stream of future payments, calculating an appropriate settlement amount is complex, including knowledge of the plaintiff’s future medical and financial needs, investment markets, income tax laws, and annuity contracts. In many cases, the attorneys lack the necessary knowledge or experience to determine the optimum terms. Once the details of the settlement amount are known, a structured settlement broker negotiates with one or more insurance companies on behalf of the qualified assignee to purchase the annuity.

Structured Settlement Professionals

Before settlement, the plaintiff and their attorneys consider the plaintiff’s short-term and ongoing needs to develop an equitable damage payment. Determining whether a structured settlement is applicable and if the elements of the settlement are justified requires expert knowledge. The plaintiff’s needs may be immediate (medical expenses, rehabilitation and retraining costs, restoration of lost or damaged assets) and future (long-term care, future education, replacement of lost income and opportunities).

Specialists in structured settlements wear different hats and serve diverse purposes in the process. They are referred to as “consultants,” “planners,” or “brokers.” People typically use the terms interchangeably even though they provide distinctly different services in the structured settlement process:

- Structured Settlement Consultant. The term “consultant” is a catch-all phrase meaning someone who offers advice to others for a fee: legal consultants, financial consultants, landscape consultants, management consultants, and many more. The term does not require any certifications, licenses, or unique expertise. Nor does it imply a level of capability. Aunt Mabel could market herself as a “cooking consultant,” and Cousin Jerry might be a “physical consultant.”

- Structured Settlement Planner. The term “planner” is like “consultant” in that anyone can call themselves a “planner.” In the structured settlement field, a planner typically assists trial attorneys with specialized financial and investment knowledge to quantify a plaintiff’s future financial needs. The term refers to those with specialized knowledge of investments, insurance, estate planning, and income tax regulation.

- Structured settlement Broker. The term “broker” refers specifically to those individuals with the appropriate State and Federal licenses to sell fixed and variable annuities within the State. Fixed annuities require a life insurance license, while variable annuities require a securities license.

A broker may represent one insurance company or several. Structured settlements involving the United States require that a broker have a “current license or appointment issued by at least one life insurance company to sell its structured settlement annuity contracts or to act as a structured settlement consultant or broker for the company.”

Brokers can provide similar services as planners in the structured settlement process and solicit annuities to complete the funding of the settlement obligations. Planners lack the appropriate license and agent agreements and cannot sell the annuity contracts in a structured settlement agreement.

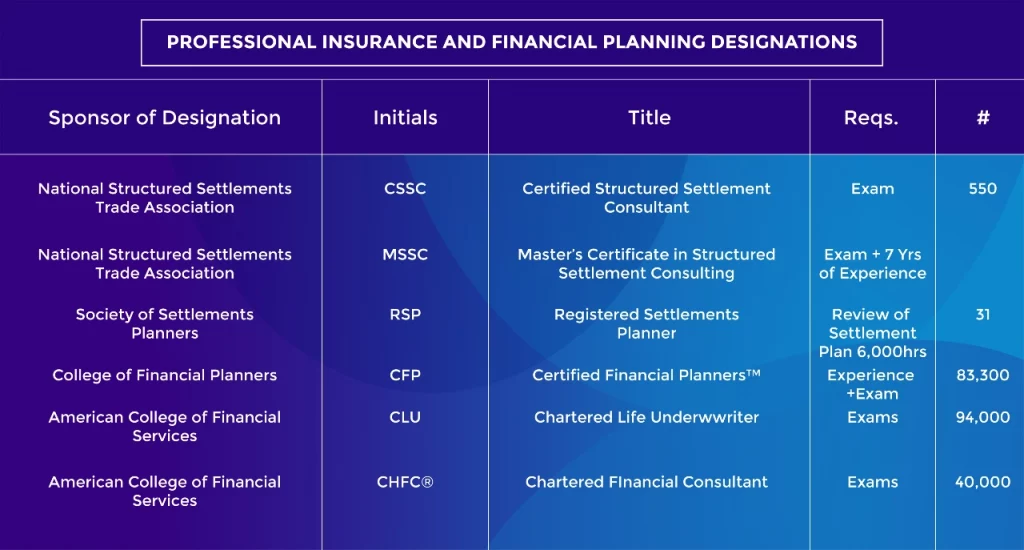

Certifications of Structured Settlement Parties

Certifications add to confusion since many do not recognize the differences between CSSC, CLU, or CFP. The misunderstanding includes the roles of each in the structured settlement process. Some in the field are particularly aggressive in adding professional acronyms to their resume with the intent of bolstering the market for their services:

Certification ensures that its holder has been tested and passed an examination of their knowledge of the subject. However, it is not a measure of experience or competency – the ability to use the information effectively. Competency is best verified by reviewing past engagements and interviews with previous clients. The number of structured settlement professionals varies greatly depending on inclusion criteria. Planners (CFPs, CLUs, and ChFCs) are typically the largest group, lacking either insurance licenses or agreements to represent a specific annuity company. The American Association of Settlement Consultants, an industry group of life insurance companies, trust companies, and other settlement industry providers who provide products and services for injured claimants and their families, estimate 800 licensed settlement consultants, i.e., brokers, in the United States. Those with industry certifications represent a smaller subset of the larger group. Many brokers and planners belong to multiple associations.

Using a Structured Settlement Professional

Plaintiff and defense attorneys will benefit from the services of a knowledgeable, experienced structured settlement professional early in the process to

- Design a settlement package that maximizes payments, conforms with regulations regarding public social programs (Workers’ Compensation Medicare Set Aside), and minimizes income taxes.

- Propose potential settlements acceptable to both sides without the uncertainty, cost, and trial delay. According to the American Bar Association, “Parties often do not want to live under the cloud of litigation for protracted periods with prolonged expenses with lengthened emotional stress,”

- Structure settlements in the interests of both plaintiffs and defendants through the former’s receipt of a designed, long-term payment series and the latter’s release of future liability.

- Protect the rights of plaintiffs who cannot protect themselves due to age or mental condition. Structured settlements secure their long-term financial interests through oversight by an independent third party and the force of law. For example, the sale of a settlement’s future payments to a child injured in an accident can require the approval of a trial judge.

Final Thoughts

Attorneys are aware of the old legal maxim “A man who is his own lawyer has a fool for a client.” Few attorneys possess the investment and financial knowledge to assess the future needs of their clients or understand the nuances of a complicated, often complex settlement agreement with future and changing levels of plaintiff payments. For these reasons, the services of a competent financial adviser experienced with structured settlements and annuities are generally warranted.

[i] FindLaw.com: Structured Settlements: Pros and Cons. Access through https://www.findlaw.com/injury/accident-injury-law/structured-settlements-pro-s-and-cons.html

[ii] Annuity.org website. Access through https://www.annuity.org/structured-settlements/

Sources:

https://www.justice.gov/civil/structured-settlement-brokers

https://ringlerassociates.com/consultants/?search=&search-type=geo