The sale of annuity payments from a structured settlement will not be taxable as income, in general. However, in some instances there is tax liability when those annuity payments are sold, so it’s important to plan accordingly.

Selling your annuity?

As usual, it’s advisable to consult a qualified tax professional before selling annuity payments.

Taxes when selling structured settlements

If a structured settlement is sold in exchange for a lump sum, those funds are usually not taxable. By law, under most circumstances the IRS is not permitted to tax income from a structured settlement regardless of whether it’s paid out over a series of payments or in one lump sum. The policy behind this law is that structured settlements are intended to afford financial stability and security to the recipients. But, it should be made clear that various taxes come into play regarding specific types of structured settlement transfers.

Wrongful death/personal injury settlements tax implications

Lawsuits that involve any kind of payment (lump sum or installment) as compensation for injury, sickness, or wrongful death are not subject to taxes. That prohibition also prevents taxing any interest or capital gains generated during the payout period.

Tax on workers’ compensation settlements

Situations in which a worker is injured or afflicted with an illness because of their work, insurance companies can offer to pay the claim via a structured settlement. In these situations, the settlement funds are not taxable. As such, the injured or ill worker is permitted to sell future settlement payments and the funds received for that sale not be subject to taxation.

Tax on annuities

Tax implications when selling an annuity

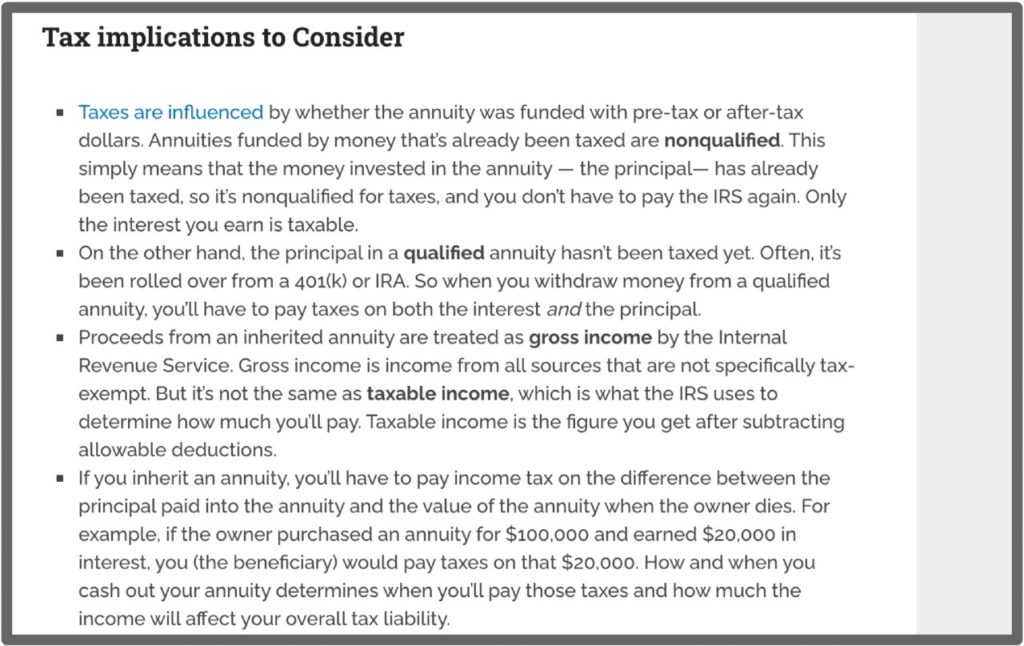

Although an annuitant has the ability to sell annuity payment rights from most types of annuities (certain accounts are excluded, such as annuities in IRA accounts), the annuitant nonetheless has to pay taxes on gains.

Also, if an annuity is sold that was not part of a court-approved settlement, then those earnings will be taxable. In addition, the annuitant would have to pay a 10% penalty if the annuitant is under age 59 ½.

Inherited annuity tax implications

Annuities permit the annuitant to name family members or friends to receive the remaining annuity payments after the annuitant dies. Whether or not the inherited payments are taxable depends on various factors, so it is advisable to consult with a tax professional when estate planning.

Our annuity beneficiary article discusses possible tax implications for people who inherit annuities.

CNN Money reviews the financial impact of annuity withdrawals.

Tax impacts of annuities and 1035 exchanges

Under the tax law, the recipient of a structured settlement annuity can choose to purchase an annuity contract with a different company and transfer the funds from the original annuity without incurring tax liability in the exchange. Reasons for this purchase would be if the annuitant wants to open an annuity at a more reputable company, or if the new company is offering more favorable terms such as lower fees or a higher interest rate.

However, it should be noted that if an annuitant wants to modify their existing annuity contract terms rather than execute a 1035 exchange, then future installment payments from the modified contract may be subject to tax.

Taxes on partial annuity withdrawals

If an annuitant wants to withdraw some of the funds in his/her annuity but wants to allow the remaining amount to remain in the annuity and grow, the lump sum withdrawal will be taxable. However, the amount remaining in the annuity will continue to grow tax-free.

Are payments from qualified annuities taxable?

So-called “qualified annuities” are annuities that are opened with funds that have not already been taxed. In the event payments are made from a qualified annuity, then those payouts are taxable.

Kiplinger reviews tax deferral options for non-spouse annuity beneficiaries.

Annuity transfers and taxes

An annuitant can assign ownership of an annuity to another person (e.g. a family member or close friend), but in those cases any income accumulated by the annuity when the transfer occurs will be taxable. However, if ownership of an annuity is assigned to a spouse or former spouse during a divorce settlement, then the transfer is not taxable. It should also be noted that a gift tax may apply if the amount of the transferred annuity exceeds the current exclusion rate (which is the amount over which taxes kick in).

Taxes on annuity losses

If an annuity loses value because of a downturn in the market, the annuitant is not allowed to declare it as a loss of income. Accordingly, a loss in value can’t be used to offset any other capital gains. However, there are different tax rules that apply to treatment of annuity losses depending on whether the annuity is qualified or non-qualified. In these cases, it’s advisable to consult a tax professional that is familiar with these issues.