Selling your annuity or structured settlement to an annuity buyer can provide access to cash that you cannot otherwise use. The cash that you receive will be less than the total of your future payments.

3 options to sell your annuity

Yes, you can sell annuity payments for cash. If an annuity does not fit your financial needs or desires, you can work with an annuity factoring company, like us, to sell some or all payments for a lump sum of cash. The most common options are 1) entirety, 2) partial, and 3) lump sum.

Get a Free quote

1) Entirety – selling an annuity pays out the entire investment as a lump sum and forfeits the annuity holder’s ability to receive future periodic payments. This is the most straightforward way to sell an annuity.

2) Partial – a partial buyout allows the annuity holder to sell a portion of his/her annuity payments and still receive periodic income without forgoing the tax benefits. For example, if the seller needs money immediately, he/she can sell years 1 – 5 of his/her annuity payments in exchange for a lump sum. After those five years have lapsed, the periodic payments will continue. Also, if the seller needs additional funds, he/she can buyout another portion of the remaining payments in exchange for lump sums.

3) Lump Sum – like a partial buyout, an annuity holder can choose to sell a portion of annuity settlement/structured settlement, in exchange for a lump sum. This approach gives the seller more flexibility in choosing the amount of the lump sum, which would be deducted from future payments.

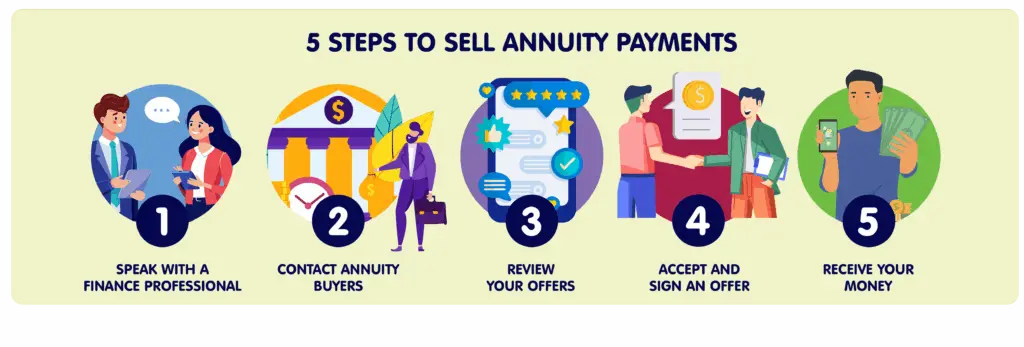

How to sell payments: A 5-step process

Selling your annuity payments is a multi-step process that doesn’t have to overwhelm you. The five steps below will help you move forward with confidence:

- Speak with a finance professional.

If possible, speak with a certified public accountant, tax attorney, or certified financial planner experienced with annuity transactions. They can help you understand financial and tax implications, and other options for obtaining cash. While we cannot force you to accept our advice and would not want to, an independent professional could help improve your financial future regardless of whether you sell payments. - Find a trustworthy annuity company.

Contact multiple factoring companies that focus on buying annuities to improve your chances to get a good deal. Our team offers free reviews of payment schedules and amounts to determine what your annuity is worth and how much money we can offer. - Review your offers.

Remember that the present value of your payments is worth less than the total of your scheduled payments. Any potential buyer that you speak with, including us, will offer you less than present value to cover fees and profit. You will have decide whether any of the offers meet your financial needs. - Finalize Your deal.

Sign the sales paperwork to make your deal official. Be sure to read everything carefully and keep a copy of these documents for your records. - Receive your funds.

Payment timing depends on the particulars of your deal. Your cash may arrive as quickly as a couple of weeks of signing your contract, but we commonly see it take longer. Annuity Freedom strives to keep our clients updated on the timing of their payments.

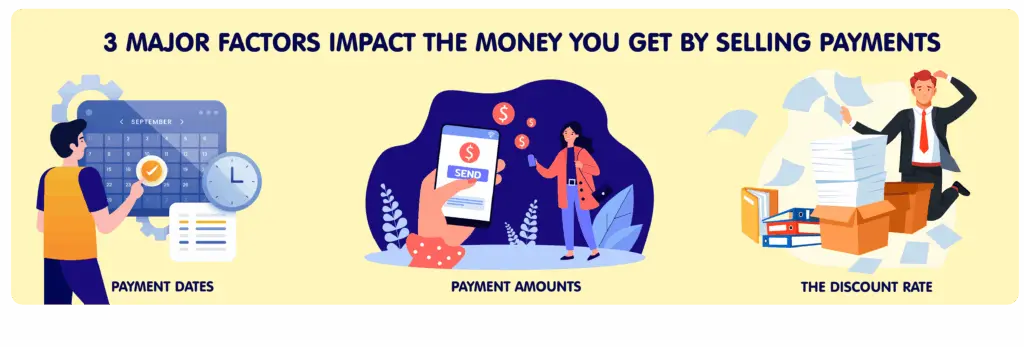

How we calculate your cash offer?

The amount you receive for selling your annuity will depend on various factors such as the size of your annuity, your payment schedule, the number of payments remaining, and the discount rate. The “discount rate” is the fee the buyer charges in order to profit on the sale and will directly impact the amount of your lump sum. After considering in all of these variables, you will be in a better position to decide if selling your annuity makes sense for you.

Also, it’s a good idea to ask any potential buyer for a detailed breakdown of their quote to ensure there are no hidden fees and all charges are transparent. It’s a good idea to request quotes from more than one company to ensure you can make an informed decision since multiple factors are involved in creating a quote.

Payment Timing: Get cash within weeks

The actual process of selling an annuity can between two weeks for an investment annuity to eight weeks for a structured settlement. As a result of this lengthy timeline, many companies (ours included) will pay you what’s known as an “advance”. Once you agree to sell us your annuity, we can offer you an immediate cash advance, provided you are qualified. We will deduct this money from your lump sum after the sale is finalized. Our advances are interest free and there are no additional fees. If your need cash quickly, an advance can be a good way to secure some up front money to help pay any outstanding debts.

Common Questions About Selling Payments

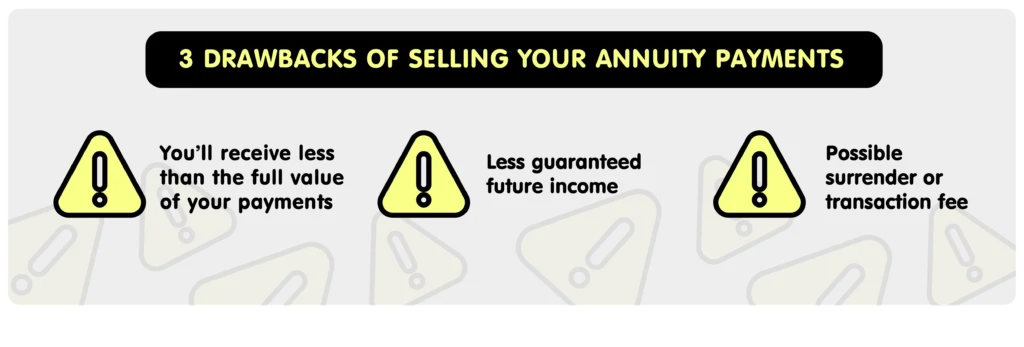

Beware: What are the drawbacks to selling an annuity?

There are some drawbacks to selling an annuity. For example, selling an annuity can result in a “surrender charge,” which can be as much as 10%. In addition, the seller won’t be able to collect any future payments from the annuity, which can be problematic for managing your future finances. Lastly, there are likely to be tax implications.

What are the benefits of selling annuity payments?

Do you owe taxes after selling your annuity?

Are you considering selling payments? Are you concerned about the repercussions of selling? Learn more about tax implications from selling your annuity.

All tax information that we provide is general. We are not tax experts and are not trying to pretend that we are. Further, we do not any of know your financial or life circumstances. We recommend that you consult with a tax professional when considering a transaction that includes selling annuity payments.