A brief summary of fixed annuities:

- A fixed annuity is a retirement investment that offers guaranteed, regular payments over a set period or for life, providing stability and predictability without exposure to market fluctuations.

- Fixed annuities can be funded with a lump sum or flexible payments over time, growing during the accumulation phase and later providing regular income during retirement in the distribution phase.

- Fixed annuities are suited for different retirement planning needs. They come in immediate versions that provide quick income after a lump-sum payment and deferred versions that allow flexible contributions with payouts starting later. .

- Fixed annuities offer simple, secure, and predictable income with low entry costs and better returns than savings accounts, but they have limited growth potential, end after a set term, and can lose value over time due to inflation.

- When considering a fixed annuity, it’s important to understand that taxes will apply upon withdrawal, initial high interest rates may drop, early withdrawals can incur penalties, state—not federal—regulations apply, guarantees depend on the insurer’s reliability (not FDIC), and without proper planning, your annuity may not transfer to heirs.

Fixed Annuities: Everything You Need to Know

Planning for retirement doesn’t have to be daunting. With so many options available in an alphabet soup that includes everything from IRAs to CDs to 401(k)s, it’s easy to feel overwhelmed. That’s just one reason it’s worthwhile to consider purchasing a fixed annuity as part of the plan to protect your financial future.

A fixed annuity is an investment you make that guarantees you’ll receive regular payments of a fixed amount, either for a specified period of time or for the rest of your life.

Introduction to Fixed Annuities

If you think the description above sounds a lot like a pension, that’s a good point. Pensions are a good starting place for understanding annuities, since an annuity is basically a way to set up a self-financed pension.

The general description of an annuity is a contract with an insurance company, bank, broker-dealer, or financial services company that makes an investment upfront in exchange for a regular stream of income.

These days, uncertainty about Social Security is rising, and fewer companies offer traditional pensions. Social Security is on course for depletion by 2035 — sooner if payroll taxes end. By 2020, the number of companies offering pensions dropped to 17% from more than twice that level (38%) four decades ago.

A typical defined-benefit pension — based on years of service and salary — makes regular payments to a retiree via a lifetime annuity. As these have become less common, private annuities have emerged as an alternative.

If you’re thinking about buying an annuity product as part of your retirement planning to supplement your retirement income, there are a few things you should know.

First of all, there are various types of annuities that offer many different features. You can set up payments for a specified number of years (usually 10-15) or for the rest of your life.

The shorter the period of time, the higher your monthly payout; but the downside is that your income will stop at some point. The longer the period of time — and if you choose a lifetime annuity — the less money you’ll get each month.

Sound complicated? It doesn’t have to be. If you want to “set it and forget it,” there’s a great option that’s worth considering: a fixed annuity. These are the safest and most straightforward type of annuity, and they’re worth discussing with a certified financial advisor.

What Are Fixed Annuities?

A fixed annuity is a likely option if stability is your top priority. If you buy a fixed annuity, you’ll get a modest rate of return, but you’ll be guaranteed a specific rate of return/ interest rate — one that can’t go up or down unless it’s built into your contract.

Another upside: You won’t have to pay any maintenance fees. Such charges — to offset risk or pay for administrative expenses — are common with variable annuities, which we’ll discuss a little later. In variable plans, these can amount to something like 0.15% a year, but they’re not a worry with a fixed annuity.

Fixed annuities can be compared with certificates of deposit (CDs). Both offer regular, stable income streams without putting principal at risk, but the rate of return is generally higher with a fixed annuity, which can be described as a “supercharged certificate of deposit.” A five-year CD can pay out only 2.5%, but a fixed annuity over the same period can yield 3.25% a year.

You can purchase a fixed annuity to distribute money over a specified period of time, such as 10 or 20 years, at which point your account will be depleted and your payments will end. This is known as a fixed-period or period-certain annuity.

If instead you want to receive a lifetime income, you can purchase a life annuity. Under such a contract, your payout amounts will be based on factors such as your account balance and current interest rates, but you’ll keep receiving money as long as you live.

One thing to keep in mind: It’s a good idea to max out contributions to your 401(k) or IRA before purchasing an annuity. If you’re employed and have a good 401(k) plan with an employer match, most financial professionals advise that you hit your contribution limit before making outside investments.

If you want to know how much money you’ll make with a proposed annuity plan, you can refer to an annuity payout calculator. A certified financial advisor can help you determine what level of payout will meet your needs.

How Does a Fixed Annuity Work?

You can purchase a fixed annuity with a lump sum (single premium) or a series of payments, which is known as a flexible premium.

You might fund the single-premium option through the sale of a major asset, such as a home; an inheritance or other windfall; or by rolling over your 401(k) or IRA.

The second option is flexible because you can change the amount of money you contribute and/or how often you make payments over a period of time. Obviously, the more money you contribute, and the sooner you contribute it, the more interest you’ll get back.

Flexible-premium annuities are always deferred annuities, which means you won’t begin seeing payments until at least one year after your purchase (see below for more on deferred annuities).

In exchange for your contributions, you’ll get regular income payments during your retirement.

This process operates in two phases: the accumulation phase and the distribution phase (sometimes known as the annuitization or payout phase).

During the accumulation phase:

- The buyer pays money into the annuity, causing it to accumulate, earning interest through investments. In simplest terms, the accumulation period is the time between when you start paying premiums and when you begin to take payments.

- You may be able to withdraw some money during the accumulation period, but you’ll likely face a withdrawal charge if you do.

- Money in the policy grows and accrues interest on a tax-deferred basis, meaning you won’t have to pay taxes on it until after you begin taking payments.

During the distribution or annuitization phase:

- At a point you specified in the original annuity contract, you begin to withdraw money from the annuity via regular payments of a fixed amount.

- These payments are subject to taxation.

- The money that remains in the annuity account continues to grow on a tax-deferred basis.

- The payments come your way for the duration of the time period you specified in the contract.

Two Types of Fixed Annuities

The two main types of fixed annuity — immediate and deferred — refer to the time frames in which different parts of the annuity are activated.

Immediate fixed annuities:

- The distribution phase kicks in within a year after you’ve started making payments on an immediate annuity — in some cases, right after you sign up.

- The purchase of an immediate fixed annuity is typically made with a single lump-sum payment, rather than a series of payments.

- These can be used to create a source of retirement income. If you’re already retired and have saved a large sum, you may not want (or need) to access it all at once.

Maybe you’ve already paid off your mortgage, for example. An immediate fixed annuity offers you a way to generate guaranteed monthly income while maximizing your assets by earning interest.

Deferred fixed annuities:

- Payouts on a deferred annuity don’t begin until at least one year after purchase.

- A lump-sum payment isn’t necessary: Buyers can make contributions over several years, rather than all at once. This can be helpful if you don’t have a large sum of money on hand but do have a regular source of income.

- These can be used to save up for retirement if it’s still a few years away, allowing you to keep a healthy stream of income flowing in after you stop working.

- If you take a withdrawal before age 59½, you may have to pay a 10% penalty to the IRS on top of any income taxes you owe; in this case, interest is withdrawn before principal.

Fixed Annuities vs. Other Types of Annuities

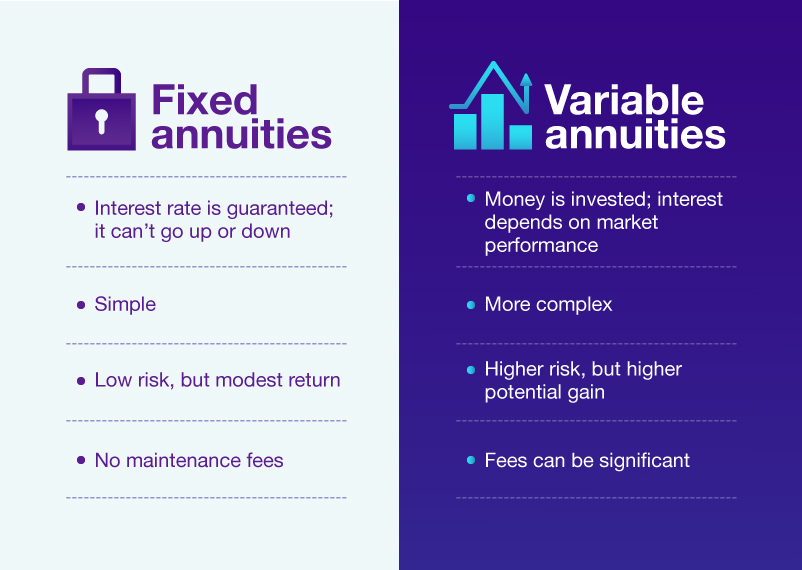

Fixed annuities aren’t the only types of annuity available. You can also choose a variable annuity, which can offer greater rewards — but also carries greater risk. Or you may want to consider a fixed-indexed annuity, a middle ground that offers more potential upside but also lets you limit gains and losses.

If you choose either of these options, you’ll also be sacrificing some of the simplicity associated with a fixed annuity.

With both the variable and fixed-indexed annuities, you’ll have to deal with a much more complicated formula for calculating your returns. Another downside is that there’s a much higher surrender charge if you choose to cash out.

Variable annuities

- Money from the annuity is invested in mutual funds, so the interest returns vary with gains and losses on the stock market. It’s possible to lose money if the annuity is invested in products that perform poorly on the market.

- You pay significant management fees and other charges with a variable annuity, which can raise the overall cost of the annuity by several hundreds or thousands of dollars, depending on your contract.

- Various riders and options let you customize the annuity, such as an income guarantee or a death benefit. These riders also typically raise the price of the annuity considerably.

Fixed-indexed annuities

- With a fixed-indexed annuity, you can enjoy some of the benefits of both fixed and variable annuities.

- The financial strength of a fixed-indexed annuity is tied to a stock market index, like the Dow Jones Industrial Average or the S&P 500 (investor’s choice).

- If the market does better, you’ll make a larger amount of money with each payment; but if it does worse, the amount of your payments will decrease.

- One consolation is that you can set a limit on the amount of your gains and losses.

Pros and Cons of Fixed Annuities

As with any other purchase, it’s important to weigh the costs and benefits before purchasing a fixed annuity. A certified financial planner can help you decide whether they’re right for you. It’s a good idea to set up an appointment to talk about your options.

But to get you started, here are a few aspects of fixed annuities that you might want to discuss at such a meeting.

Benefits of a fixed annuity

- Simplicity — When you purchase a fixed annuity, you put the money in, and regular, stable payments come out later. You don’t have to keep an eye on the stock market and worry about reallocating your assets based on the Dow Jones average, bond prices, or other variables. That’s all taken care of for you.

- Security — Fixed annuities are safe. Payouts aren’t affected by market fluctuations, and interest rates are guaranteed. Unlike CDs, however, they’re not insured by the federal government; they’re backed by private insurance companies.

Still, it’s easy to increase your security by making sure you purchase your annuity from a company with a stable history and a strong reputation.

- Stability — Rates of return are set and provide income predictability, making retirement planning easier. You can set up a budget, since the amount of your monthly payout won’t change; in fact, it won’t go below a certain amount, if your contract includes a guaranteed minimum rate of return.

And since you’ll receive your money on the same date every month, you can even set up automatic bill-pay plans so there’s less worry about keeping up with your regular expenses.

- Affordability — You don’t have to make a huge buy-in to purchase a fixed annuity. Investment minimums are comparatively low, usually between $1,000 and $10,000.

- Profitability — A fixed annuity offers a higher rate of return than other low-risk options, such as savings accounts and CDs.

Drawbacks of a fixed annuity

- Less potential for gain — Fixed annuity rates limit market losses, but the flipside is that they’ve got a lower ceiling for gains. You can’t make as much money as you might if you invested in a variable or fixed-index annuity.

- Payments eventually end — The seller only guarantees payments for the term of the contract. Once the money runs out, you’ll have to find other sources of income.

- Inflation erodes value – Over the years, the value of your payments will drop because of inflation. Put simply: Your payments won’t change, but your cost of living will increase, making your payments worth less. The good news is, inflation hasn’t been a huge factor in recent years. The annual rate of inflation hasn’t gone higher than 2.4% since 2011.

If you’re still concerned about rising prices, you can pay extra for a “rider” to include cost-of-living adjustments that rise with the rate of inflation. A word of warning, though: Riders can be expensive. Will the extra price you pay outweigh the cost-of-living adjustment you’ll receive? Check with your financial advisor to determine your best option moving forward.

Important Aspects of Fixed Annuities

After considering the pros and cons of buying a fixed annuity, it’s also important to weigh other factors involved with your purchase. If this seems complicated, remember: You’re making sure all the i’s are dotted and t’s are crossed up front, so you won’t have to worry about it later.

If you decide to purchase a fixed annuity, you’ll know where you stand, and there won’t be any surprises. Everything from then on out should be smooth sailing.

Here are some other points to think about, and discuss with your financial advisor, when considering a fixed annuity.

- You’ll eventually have to pay taxes — Earnings are tax-deferred within the annuity, but “tax deferral” doesn’t mean “tax-exempt.” You’ll have to pay taxes eventually: Once you start taking money out, you’ll pay taxes on it.

- Return rates can drop — It’s common with some fixed annuity contracts to offer a high guaranteed interest rate for the first year (known as the initial rate), then a much lower rate after that (called the renewal rate). Consider the terms and conditions for the entire term of your fixed annuity. Read your contract closely before signing!

- Early withdrawal can trigger penalties — Pulling out your principal (or even a large chunk of it) before your contract ends can trigger a heavy tax penalty, as well as a surrender charge.

- States regulate annuities — The federal government doesn’t oversee annuities; your state’s insurance commissioner does. Companies that sell annuities have to register with the commissioner in each state where they do business.

The commissioner fields customer complaints and ensures that sellers abide by state regulations. Know your state’s guidelines, and if you have questions, contact your state insurance commissioner’s office.

- Payments are guaranteed by insurance funds (not the FDIC) — Unlike bank deposits, which are backed by the Federal Deposit Insurance Corporation, annuities aren’t guaranteed by any federal agency.

The security of your annuity is only as strong as the insurer that issues it, so do your research in consultation with your financial advisor to be sure your annuity is backed by a reliable, reputable seller.

- Refunds aren’t guaranteed — Your annuity balance does not automatically stay in your family, unless you arrange it beforehand.

For example: If someone purchases an annuity then dies shortly afterward, the issuing life insurance company may not be obligated to continue annuity payments to the spouse or refund premiums to the estate.

If you want to safeguard your annuity after your death, be sure the appropriate language is included in your contract. Consult a certified financial advisor for details.

Fixed Annuity FAQs

Although fixed annuities are among the simplest of retirement planning investments, their use can still raise questions. Here are some frequently asked questions about fixed annuities:

How safe are fixed annuities?

Fixed annuities are among the safest retirement planning options out there, comparable to CDs but typically yielding a better return rate, which is guaranteed. The simplicity of a fixed annuity yields predictable payment amounts that don’t change with fluctuations in the market.

Annuities are contracts with insurance providers and, as mentioned, aren’t insured by the federal government. State guaranty associations do, however, have funds that can reimburse you if an annuity defaults on its commitment, in amounts ranging from $250,000 to $1 million.

Regardless, it’s far better to feel secure with the company you choose than worry about a company’s potential bankruptcy or default. So it’s important to research which companies are most likely to provide you with the greatest security.

In 2020, more private companies have started offering annuities as an alternative for their employees’ retirement investments, alongside standard options such as 401(k)s. They began doing so after passage of the SECURE Act, which protects businesses from liability if insurance companies don’t honor their annuity contracts.

Prior to that, many businesses were reluctant to offer annuities for fear that they’d be on the hook in such cases. More than 60% of businesses named this fear as a reason for not offering annuity plans to their employees.

If you’re thinking about purchasing an annuity, the best advice is to do your research, find a well-financed seller with an impeccable record and a strong reputation, and check with your financial advisor to be sure you’re making the best possible choice. You may even want to split your purchase among different companies.

A couple of hundred domestic insurance providers offer annuities. You can narrow your choices by researching how they’re rated by the four main agencies: A.M. Best, Fitch, Moody’s Investors Services, and Standard and Poor’s (S&P).

Each agency uses a different rating method, similar to a classroom grading scale. Check any proposed seller using the scale employed by the rating agency you decide to consult.

What fees and charges are involved in a fixed annuity?

Generally, the more complex an annuity is, the more you can expect to pay in fees and charges. Costs to consider include the following:

- Premium — The premium is the amount that you pay into the annuity, whether as a lump sum or a series of payments. Minimum premiums can be as low as $1,000 and rise to $100,000.

- Commission — The amount of money an agent makes for selling an annuity is the commission. It’s generally built into the contract, so it may not be obvious, but the commission on a 10-year fixed annuity is generally between 6% and 8%.

Here are a couple of things to know about commissions:

- The more complicated your contract is, the higher your agent’s commission is likely to be. Ask your financial advisor about the size of the sales commission and how much it affects your contract and overall price.

- An agent has skin in the game and may talk up the positive features of an annuity while minimizing potential pitfalls. Read any proposed contract carefully and consult with your financial planner to be sure any deal is right for you.

- Administrative/maintenance fees — There are payments associated with an annuity’s record-keeping and administrative work. They may take the form of an annual fee of $50 to $100 or a percentage of your account value (typically not more than 0.3%).

- Mortality/expense risk fees — Mortality fees offset the risk taken by the insurer who sells you an annuity contract. They serve as a buffer for the company in case certain factors change — most notably your life expectancy (hence the name).

These are generally about 1.25% a year, but can range from 0.5% to 2% of your contract’s value.

- Riders — You may want certain stipulations added to a contract, based on your specific needs; you can do this for an additional charge. For example, you might want a rider that allows you to pass on your benefits to a beneficiary if you pass away, or to guard your payout amounts against inflation. Riders can cost between 0.25% and 1% a year.

- Surrender charge — You’ll pay a penalty if you need to cash out of your annuity before the surrender period. This typically applies to any full or partial withdrawals you make before your regular payments are set to start, and should be covered in your contract. (There’s usually no penalty for withdrawals up to 10% of your principal.)

Generally speaking, these fees decline with time, as you get further into your contract. They might range from three to 10 years, but they can still be invoked as long as 15 years after the start of your contract.

Note: If you choose to make withdrawals, you’ll be tapping your interest first, then your principal.

The simplest fixed annuity with no riders often incurs no maintenance fees and only minimal other charges. Consult a certified financial advisor or other qualified financial professionals for guidance.

Can you fund an annuity with IRA dollars?

Yes, you can buy a fixed deferred annuity with IRA money. If you do, though, the tax rules that apply to IRAs will apply to all funds in the annuity. These tax rules stipulate contribution limits, the type of investment product held, and the required minimum distributions.

You also can buy a deferred annuity with nonqualified money (non-IRA funds).

Here are a couple of terms to keep in mind when dealing with taxes:

Qualified funds are money that hasn’t been taxed yet. They come from sources such as IRAs and 401(k) plans.

When you’ve transferred funds from sources like these into an annuity, your entire payout will be taxed as income when you withdraw it — not just the interest, but the principal, too. Also, you’ll be required to start making withdrawals by a certain age.

Nonqualified funds are principal that has already been taxed and, therefore, can’t be taxed again. As this principal earns interest, however, the interest it accrues is subject to taxation.

Can I sell a fixed annuity if something comes up?

If you find yourself needing cash in a hurry, then yes, you can legally sell all or part of your fixed annuity for cash. If you sell the annuity all at once, you’ll receive no future payments.

If you sell a portion of your payments (say, years 8-10 of your 20-year annuity), you will receive a lump sum of cash up front, and will resume receiving periodic payments later.

However, be aware that there are downsides to selling an annuity:

- Disruption of the annuity contract may trigger surrender charges and other penalties.

- You may not get the full amount of your annuity’s initial contract value. Annuity buyers purchase annuity contracts at discounted rates, sometimes as low as 50% of the annuity’s initial value.

If you’re interested in exploring this step, research annuity buyers to find the best option and check with your financial advisor. Once you commit to selling your annuity, it typically takes about four weeks to process the insurance company’s paperwork before you see any money.

What happens to my fixed annuity if I die early? Will the insurance company keep all my money?

Here’s one good argument for carefully directing the terms of your contract before signing:

If your original annuity contract contains a death benefit provision, the amount remaining after your death can be left to a beneficiary, distributed by the insurance company in a lump sum or series of payments.

However, if there’s no death benefit provision in the annuity for continuing payments to your beneficiaries, the amount remaining in the annuity stays with the insurance company, which uses it to fund payouts for other annuitants.

This is how the insurance company keeps from losing money: by balancing those who outlive their life expectancy against those who die early, or by charging extra for a death-benefit rider.

Without this provision, if you die young, you won’t receive the full amount of money you’ve put in. But if you outlive your life expectancy, you’ll benefit from money left in the fund by those who died early.

When designating a beneficiary, you can choose a person or an organization.

If you choose to leave your annuity to your spouse, it usually happens in a process called spousal continuation. If you die, your spouse should be able to simply “take over” the contract, continuing it while maintaining the same rights, responsibilities, and options exercised by the original annuitant (you).

Or you can leave your annuity to someone other than your spouse, such as a child. But if you do so, that beneficiary won’t be able to change the terms of the contract. (Children are not allowed to access an annuity they’ve inherited before the age of 18.) Either way, the same rules continue to apply regarding taxes, surrender charges, etc.

How do I know if a fixed annuity is right for me?

Of course, the appropriateness of an annuity depends on your situation. Different retirement plans, insurance products, and investment strategies fit different individual needs, portfolios, and time frames for retirees and other investors.

If you have a long time frame and want a no-risk investment, a fixed annuity might be a good choice, especially if you inherit a lump sum of money, have sold a major asset like a home, or receive a bonus or other windfall. As with every major investment decision, you should consult a certified financial advisor for more information.